When people talk about “the market” they are generally referring to an index. These markets have become increasingly important today such that indexes like the Dow Jones Industrial Average (DJIA), the S&P 500 and Nasdaq are now part of our vocabulary.

An index is a statistical measure of the changes in a portfolio of stocks that represent a portion of the overall market. Since it would be difficult to track every single share on the stock market, a sample size is taken that is representative of the whole market. Therefore an index is essentially a portfolio of shares. The only way that it can actually be traded is by buying all the shares in the portfolio in the same proportions, and re-balancing the portfolio whenever the index composition changes. It goes without saying that this is both a difficult and a costly task. For this reason, indices are usually traded as futures contracts, which are standardized contractual agreements to buy or sell a particular commodity or a financial instrument at a pre-specified price on a future date.

You can now trade equity indices in the form of CFDs straight from your trading account. The pricing of all indices is based on the underlying spot futures contracts.

On the easyMarkets trading platform, the trader can trade the following indices:

Indices Pricing

| Index | Instrument | 1 contract | Pip value* | Min Contract | Min Margin** | |

|---|---|---|---|---|---|---|

| US 500 (SPI) | SPI / USD | 1 * Index rate * 50 USD | 0.50 USD | 0.02 * Index rate * 50 USD | 25 USD | |

| US 30 (DOW) | DOW / USD | 1 * Index rate * 5 USD | 5 USD | 0.02 * Index rate * 5 USD | 25 USD | |

| US Tech (NDQ) | NDQ / USD | 1 * Index rate * 20 USD | 0.20 USD | 0.02 * Index rate * 20 USD | 25 USD | |

| UK 100 (FTS) | FTS / GBP | 1 * Index rate * 10 GBP | 1 GBP | 0.02 * Index rate * 10 GBP | 20 GBP | |

| Germany 30 (DAX) | DAX / EUR | 1 * Index rate * 12.50 EUR | 1.25 EUR | 0.02 * Index rate * 12.50 EUR | 25 EUR | |

| EU Stocks 50 (ESX) | ESX / EUR | 1 * Index rate * 10 EUR | 10 EUR | 0.02 * Index rate * 10 EUR | 25 EUR | |

| France 40 (CAC) | CAC / EUR | 1 * Index rate * 10 EUR | 1 EUR | 0.02 * Index rate * 10 EUR | 25 EUR | |

| Swiss 20 (SWI) | SWI / CHF | 1 * Index rate * 5 CHF | 5 CHF | 0.02 * Index rate * 5 CHF | 25 CHF | |

| Australia (ASX) | ASX / AUD | 1 * Index rate * 25 AUD | 25 AUD | 0.02 * Index rate * 25 AUD | 25 AUD | |

| Japan 225 (NKI) | NKI / USD | 1 * Index rate * 5 USD | 5 USD | 0.02 * Index rate * 5 USD | 25 USD | |

| Hong Kong 40 (HSX) | HSX / HKD | 1 * Index rate * 50 HKD | 50 HKD | 0.02 * Index rate * 50 HKD | 200 HKD | |

| China 50 (CNX) | CNX / USD | 1 * Index rate * 2 USD | 2 USD | 0.02 * Index rate * 2 USD | 25 USD | |

| India 50 (IND) | IND / USD | 1 * Index rate * 10 USD | 1 USD | 0.02 * Index rate * 10 USD | 25 USD | |

| USD Index (USX) | USX / USD | 1 * Index rate * 1,000 USD | 1 USD | 0.02 * Index rate * 1,000 USD | 25 USD |

*Value per pip per 1 contract The pip value is shown in the non-base currency, the spread is a decimal resulting from the difference of BID and ASK, i.e. 120.264 – 120.238 = 0.026.

**Minimum margins to trade and contracts we show an approximation of margin based on how the financial markets display prices. Margins will vary based on your base currency.

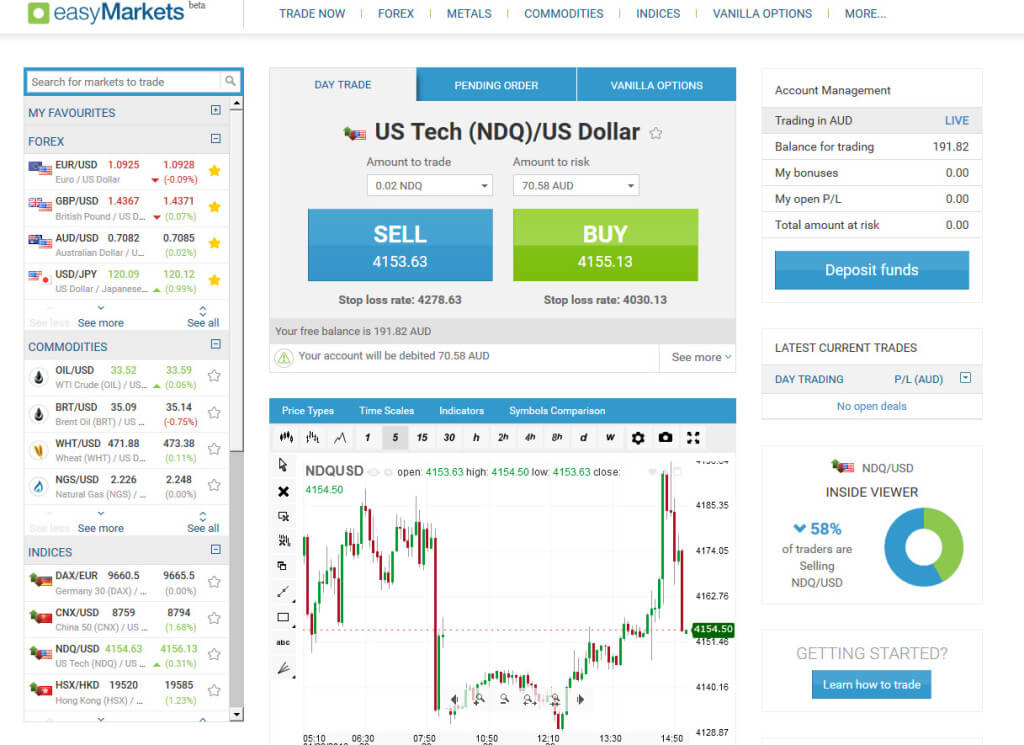

How to open a Day Trade on an index with our Web Trading platform

1. First, log into your account.

2. Select the Indices tab at the top of the screen.

3. You will notice that the Rates Table on the left changes to Indices. You can customize your indices table in the same way you can customize your currency rates table.

4. Select which Index you wish to buy or to sell.

5. Select the contract size you would like to trade (note that the position size is defined as the number of contracts – the next section describes how to find the value of a contract)

6. Select your margin to risk from the drop down menu

7. Your Stop Loss is set automatically according to the margin you have chosen to risk. You can change this after you’ve opened your deal by clicking ‘modify’ in the My Position area

8. Click ‘Buy’ or “Sell” to open the deal.

9. The expiry date of the contract is shown in the trading ticket